Salary and tax calculator

Calculation are split by week month and year. The Salary Calculator tells you monthly take-home or annual earnings considering Irish Income Tax USC and PRSI.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Minimum Salary For Filipino Maid In Dubai In 2021.

. For instance an increase of CHF 100 in your salary will be taxed CHF 2690 hence your net pay will only increase by CHF 7310. After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand salary calculator. United Arab Emirates salary after tax calculator.

The calculator is designed to be used online with mobile desktop and tablet devices. Many contractors pay themselves a minimal salary keeping income tax and NICs low taking the remainder of their income as dividends. By default the 2022 23 tax year is applied but if you wish to see salary calculations for other years choose from the drop-down.

Its so easy to use. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Tax System in the UAE.

When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. Your average tax rate is 270 and your marginal tax rate is 353. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month.

LATEST SALARY INCOME TAX SLAB RATES IN PAKISTAN FOR TAX YEAR 2023. Free for personal use. Cost of Living Calculator.

Calculate your value based on your work experience and skill set. According to the revised income tax slabs for FY 2022-23 Income tax rates has been revised and have been increased as compare to previous tax year ie. This is based on Income Tax National Insurance and Student Loan information from April 2022.

Our tax calculator uses tax information from the tax year 2014 2015 to show you take-home pay if you need to see details of PAYE and NI for a different year please use our advanced options. Review the full instructions for using the Ireland Salary After Tax Calculators which details. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12.

US Tax Calculator and alter the settings to match your tax return in 2022. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Sage Income Tax Calculator. The Monthly Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. If you make 50000 a year living in Australia you will be taxed 7717That means that your net pay will be 42283 per year or 3524 per month.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. Inform your career path by finding your customized salary.

Calculate how tax changes will affect your pocket. This places Spain on the 20th place in the International Labour Organisation statistics for 2012 after United Kingdom but before Luxembourg. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399.

Calculate your tax NI and net take home pay with Malta Salary Calculator. Button and the table on the right will display the information you requested from the tax calculator. Your average tax rate is 217 and your marginal tax rate is 360.

This 90k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Arizona State Tax tables for 2022The 90k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Arizona is used for. How to calculate income tax in Australia in 2022. Is The Salary In Dubai Tax-free.

Your average tax rate is 345 and your marginal tax rate is 407This marginal tax rate means that your immediate additional income will be taxed at this rate. Find out what you should earn with a customized salary estimate and negotiate pay with confidence. SalaryWage and Tax Calculator - Estonia Latvia This website may use cookies or similar technologies to personalize ads interest-based advertising to provide social media features and to analyze our traffic.

If you make 300000 kr a year living in the region of Aabenraa Denmark you will be taxed 103464 krThat means that your net pay will be 196536 kr per year or 16378 kr per month. Your average tax rate is 168 and your marginal tax rate is 269. UAE Salary Calculator gives an estimation of the salary you will get in hand after all tax deductions.

Quick Accurate results. Now lets learn more about the latest tax slab rates in Pakistan for the fiscal year 2022-23. You can now choose the tax year that you wish to calculate.

This number is quite a bit higher if we look at the average weekly salary coming out to. Explore the cost of living and working in various locations. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Spanish system for direct taxation of individuals is progressive with higher rates being applied to higher income levels. For instance an increase of 100 in your salary will be taxed 3525 hence your net pay will only increase by 6475. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Your average tax rate is 154 and your marginal tax rate is 345This marginal tax rate means that your immediate additional income will be taxed at this rate. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. SalaryWage and taxes in Latvia.

The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed updates and supporting tax tables. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The average monthly net salary in Spain ES is around 1 390 EUR with a minimum income of 764 EUR per month. The latest budget information from January 2022 is used to show you exactly what you need to know. Hourly rates and weekly pay.

Select the columns you would like to display on the wage summary table. Before tax thats an annual salary of 61828. The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023.

Self Employed Tax Calculator Business Tax Self Employment Self

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Salary Calculator Salary Calculator Calculator Design Salary

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Salary To Hourly Calculator

Pinterest The World S Catalogue Of Ideas Paying Scale Consumer Price Index

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Pin On Ux Ui

Pin On Raj Excel

Income Tax Calculator App Concept Calculator App Tax App App

Python Income Tax Calculator Income Tax Python Coding In Python

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

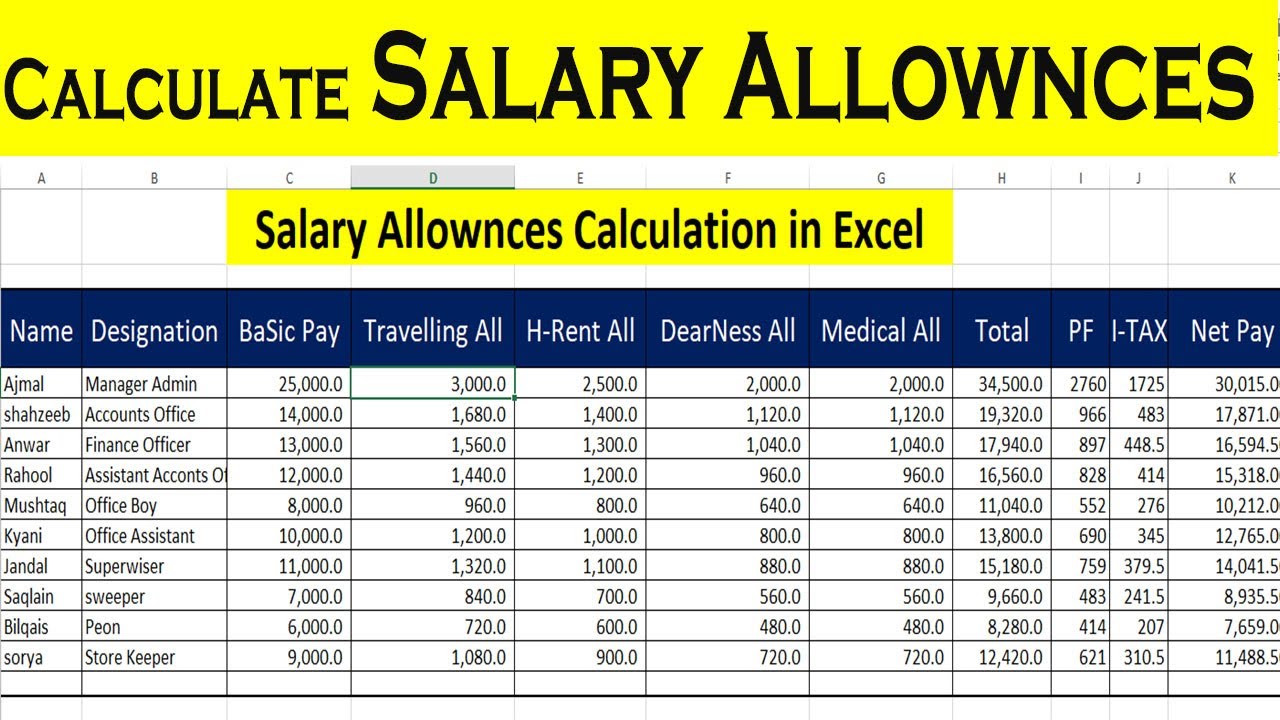

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions